REGISTRATION NO. : 01962855

VAT NO. : GB 442 7628 51

TRADING STYLE : ABC

DATE OF INCORPORATION : 14 December 1985

LEGAL STATUS : Private Limited Liability Company

REGISTERED OFFICE :

832 City Hall Road

London

ENGLAND

W1V 8DF

Tel : 44 20 7325 6888

Fax : 44 20 7325 6890

TRADING STYLE :

20 Wexford Road

London

ENGLAND

W1V 3DY

Tel : 44 20 7588 2642

Fax : 44 20 7588 2682

PRINCIPAL ACTIVITIES :

The manufacture, supply and distribution of air brake systems.

The products sold by the company include brake cylinders, brake lining, disc brakes, regulating valves, brake adjusters, air dryers, regulating valves, friction material,

hydraulic lifting systems, air suspension, air brakes, and ABS braking systems.

The company also provides services such as consultancy for braking and suspension development, brake calculations, type approvals and application engineering

Brands Sold :

Balford

Dexter

Basler

The company imports from USA, France, Germany, Italy, Spain, Denmark, India, China and Sweden.

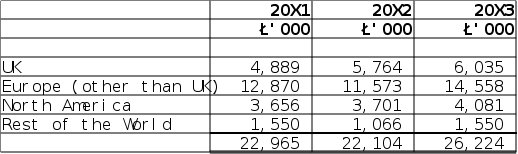

The geographical analysis by region of the company’s Turnover for the years 20X1, 20X2 and 20X3 is as follows :

AUDITORS :

Fred Wilfred LLP

Chartered Accountants

28 Cornwall Place

London

ENGLAND

W2 6LT

Tel : 44 20 7863 2800

Fax : 44 20 7863 2801

BANKERS :

London Finance Bank Plc

26 Threadneedle Street

London

ENGLAND

EC2V 5WX

Tel : 44 20 7858 6822

Bank Code : 20 35 46

SOLICITORS :

Maxwell and Vaughan

Drayton Lane

Coventry

West Midlands

ENGLAND

CV1 2WC

Tel : 44 24 7663 3856

Fax : 44 24 7625 3866

COMPANY SECRETARY :

Robert Branson

3 Bell Court

Ashbourne Road

London

ENGLAND

SW2 6NT

DIRECTORS :

Alex Wellington

Wandsworth House

Wilson Green

London

ENGLAND

W5 3WS

Date of Birth : 17.01.19XX

Nationality : British

Freddy Johnson

3 Ley Close

Barnes

London

ENGLAND

W3 6PB

Date of Birth : 28.05.19XX

Nationality : British

AUTHORISED CAPITAL :

£6,000,000 made up of 6,000,000 Ordinary Shares of £1.00 each.

ISSUED SHARE CAPITAL :

£4,500,000 made up of 4,500,000 Ordinary Shares of £1.00 each.

MAJOR SHAREHOLDERS :

The company is a wholly owned subsidiary of :

ABC Group Ltd

20 Wexford Road

London

ENGLAND

W1V 3DY

Tel : 44 20 7588 2642

Fax : 44 20 7588 2682

ULTIMATE HOLDING CO. :

Besler AB

Beltonsgatan 28

S-105 28 Stockholm

SWEDEN

Tel : 46 8 545 06 58

Fax : 46 8 545 12 66

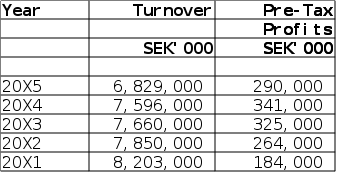

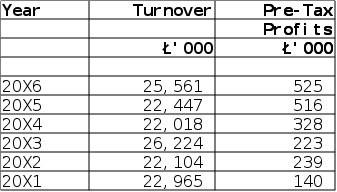

The following were the Turnover and Pre-Tax Profits of Besler AB of Sweden over recent years :

The above figures are in Swedish Krona SEK’000.

The Besler AB group employs over 5,300 persons worldwide.

AFFILIATED COMPANIES :

Besler Espana SA

SPAIN

Besler Ltd

UK

Besler Holdings Ltd

UK

Besler Italia SpA

ITALY

CHARGED INDEBTEDNESS :

On 31 August 20X3 A Chattels Mortgage over plant and equipment in favour of Mitac Capital Plc.

HISTORY :

The company was incorporated on 14 December 1985 as XYZ Ltd.

On 1 May 1998 the company changed its name to ABC Ltd.

PAYMENTS :

The company takes an average of 62 days to settle its suppliers whilst its customers settle the company’s trade debts in 29 days.

The company agrees payment terms with its suppliers when it enters into binding purchase contracts. The company seeks to abide by the purchase terms agreed with suppliers whenever it is satisfied that the supplier had provided the goods or services in accordance with the agreed terms and conditions.

OTHER INFORMATION

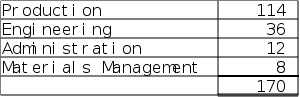

NO. OF EMPLOYEES :

The year 20X1 staff is represented as follows :

PREVIOUS NAME : XYZ Ltd

DATE NAME CHANGED : 1 May 1998

FINANCIAL COMMENTS :

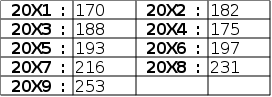

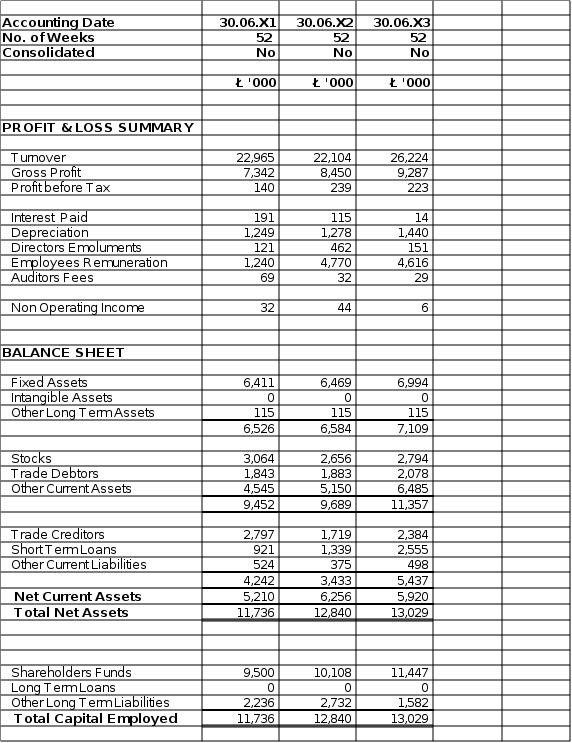

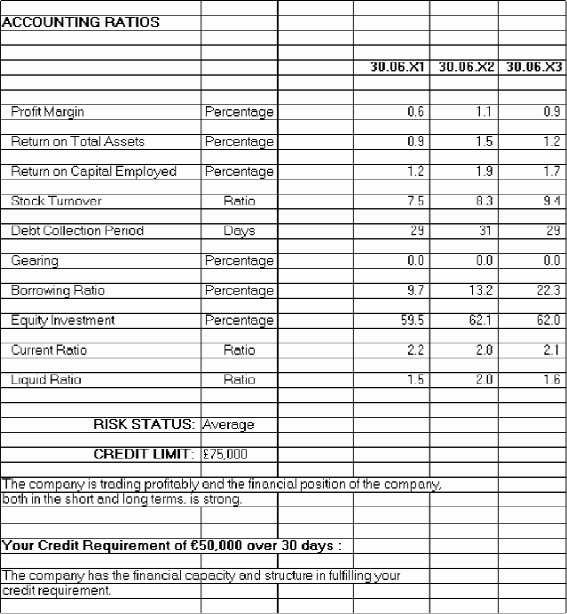

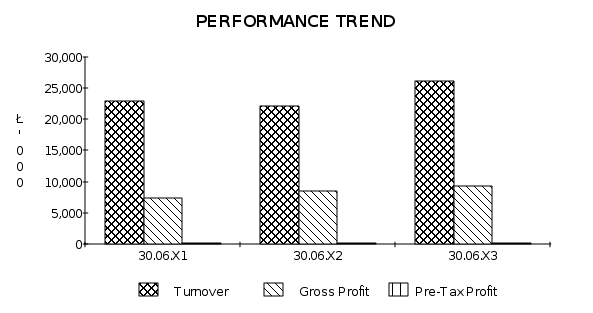

The following were the Turnover and Pre-Tax Profits of ABC Ltd over recent years :

In 20X1 the company’s profits fell despite an increase in Turnover. This was due to intense competition in the industry and the company had to squeeze its margins to maintain its market share.

ACCOUNTING RATIOS

1) Profit Margin : Profit before Tax X 100/Turnover

Indicates how well the company had achieved profits by controlling costs and improving sales.

2) Return on Total Assets : Profit before Tax X 100/Total Assets

Indicates how successful the company had utilised its assets to generate profits.

3) Return on Capital Employed : Profit before Tax X 100/Total Capital Employed

Shows the profits achieved in percentage terms in relation to long term funds invested in the company.

4) Stock Turnover : Turnover/Stocks

Indicates the number of times stocks were converted into sales during the trading period.

5) Debt Collection Period : Trade Debtors X Trading Period(days)/Turnover

Shows the average length of time (in days) the company takes to collect its debts.

6) Gearing : Long Term Loans X 100/Net Worth*

Expresses the relationship between total external long term borrowings and equity funds.

7) Borrowing Ratio : Short and Long Term Loans X 100/Net Worth*

Expresses the relationship between total external borrowings (long and short term) and equity funds.

8) Equity Investment : Net Worth* X 100/Total Assets

Shows how much of equity funds were invested in total assets in percentage terms.

9) Current Ratio : Current Assets/Current Liabilities

Shows the ability of the company in meeting its current liabilities when due.

10) Liquid Ratio : Current Assets Stocks/Current Liabilities

Shows to what extent the company is able to meet its current liabilities with immediately available assets.

*Net Worth : Shareholders Funds Intangible Assets

Ratios 1 to 5 are not normally available to "small" companies.

Ratios 1,4 and 5 are not normally available to “medium sized" companies.

VALIDITY : The Risk Status and Credit Limit calculations are based on the financial

information as at the later accounting date reflected on Page 7 of the Report.

Change in financial circumstances after this date would not have been taken into account.

CONFIDENTIALITY : This Report is specifically produced for the use of the purchaser only and should not be shown or reproduced to the company which is the subject of

the Report.

RISK STATUS : The company will be "passed" through certain risk parameters and will subsequently be classified into one of the following four risk areas:

Poor Caution should be exercised and securities or guarantees obtained before the granting of credit.

Average This is a moderate risk level and a careful examination of the Report should be made before reaching a credit decision.

Good A reasonable rating has been obtained but care should still be taken as to the amount of credit to be granted.

Excellent The company has achieved a favourable rating with a high level of net worth.

To order Credit Report on any UK or Ireland company, go to :